Idealized Trades for August 2013

Welcome, [firstname] !

Each day includes a description of some of the lessons and concepts discussed as well as the trade set-ups or examples that occurred that day.

Thank you for being a member and I hope you find value in these daily summaries and lessons.

Download the most recent report here:

August 30, 2013 (Click Here to Download)

MEMBER NOTE:

Join me live each Tuesday Morning for the “Market Briefing” at TradeStation (anyone can register)

NEW! Member Glossary (Reference Page):

Idealized Trades Terminology Glossary Page (link)

By request, I’ve set-up a Member Glossary Page of Terms used in the Nightly Reports (such as “T3 Trend Day” or “Stick Save”).

Be sure to reference and bookmark this page and always feel free to email me with suggestions to expand it.

SPECIAL REPORT:

Download: How to Make the Most of the Idealized Trades Report

New Members – always remember you have full access to prior months’ reports for review and additional examples of the concepts I teach and trade.

Archives:

August 1, 2013 Download August 1 2013

T3 Trend Day UP, Alternate Breakout and Bigger Move, Four “Flag” Retracement Trades, refresher on Narrative + Game-Plan + Day Structure/Real Time strategy

August 2, 2013 Download August 2 2013

Jobs Report, Trend Day UP after initial gap down, Breakout, Reversal, and Flag/Retracement Trades

_______________________

August 5, 2013 Download August 5 2013

Range Day, Low Volatility Compression/Consolidating, Failed Retracements (leads to breakdown), “Cautious” Game-plan between $170 and $171 level (good example)

August 6, 2013 Download August 6 2013

Shift to “Cautious” Game-Plan pays off as market “collapses” on movement under $170 with an initial T3 Trend Day. Quick lesson on tight vs. wide stop-losses and the trade-off in management (Trade #2 today).

August 7, 2013 Download August 7 2013

Bull-Trap downside continuation, bear flags (morning), divergence into kick-off “rounded reversal” with good Breakout into First Reaction two-step trade

August 8, 2013 Download August 8 2013

Opening Gap (fade/failure), V-Spike Reversal (great example), Breakout into First Reaction (again), retracement/flag, key battle at 1,700

August 9, 2013 Download August 9 2013

Semi-repeat day, V-Spike Reversal, Stick-Save into Breakout and First Reaction, Morning Bear Flag/Cradle Trade

_____________________________

August 12, 2013 Download August 12 2013

Large Gap Down (filled), Three pro-trend retracement ‘flag’ trades, end-of-day rounded reversal

August 13, 2013 Download August 13 2013

ANOTHER V-Spike Reversal, Failed bear flag leads to Popped Stops Breakout (and first reaction two-step trade – great example), afternoon retracements

August 14, 2013 Download August 14 2013

Dominant (Range) Thesis Trend Day Lower (away from $170 toward $169), valid morning retracements, a weak breakdown into first reaction (failed bullish reversal example)

August 15, 2013 Download August 15 2013

Dominant (Breakout) Thesis into Trend Day Lower (away from $168 toward $166), valid morning retracements, Trend Day with clean ‘flags’ and dominant thesis (game-plan) price action

August 16, 2013 Download August 16 2013

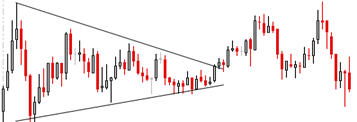

Initial bounce off $166 – failed with Symmetrical Triangle Breakdown – retracement trades into divergences at $165.50 higher frame target

_______________________

August 19, 2013 Download August 19 2013

T3 Trend Day Down, Failed Reversal off Daily Support, Breakdown into First Reaction then Flag/Retracement Trade examples

August 20, 2013 Download August 20 2013

Dominant Thesis (great example) T3 Trend Day UP, reversal/breakout into three retracement/flag trades

August 21, 2013 Download August 21 2013

Fed Day (Minutes), Session played out “exactly” as it should, Morning gap and retracement, “Down/Up/Down” Fed reaction/volatility (typical)

August 22, 2013 Download August 22 2013

Range Day, Dominant Thesis bullish (expected outcome), Breakout into pro-trend (shallow) retracements

August 23, 2013 Download August 23 2013

WEAK T3 Trend Day, gap into shallow retracements, play at $166.50 key higher frame level

_______________________

August 26, 2013 Download August 26 2013

Another Weak Trend Day (retracement/flags), Divergences into two visual bearish Kick-offs, end-of-day collapse of the market on Syria news

August 27, 2013 Download August 27 2013

T3 Trend Day Collapse, Syria, Lessons on Trading (and identifying) T3 Trend Days (reminder that we do not fight them), High Volatility Shift

August 28, 2013 Download August 28 2013

Gap Down into V-Spike Reversal (divergences), Breakout into First Reaction and Cradle Trade (best trade of the day), retracement and TWO Stick-Saves

August 29, 2013 Download August 29 2013

Downside Gap into Sudden Fill (semi V-Spike), Alternate Bullish Thesis successful, Breakout into Retracement, Stall/Reversal (with divergences and kick-off) into $165, breakdown into First Reaction

August 30, 2013 Download August 30 2013

T3 Trend Day into “spike” Rounded Reversal, Syria News Event, Flag/Retracements