Idealized Trades for July 2012

Welcome, [firstname] !

Each day includes a description of some of the lessons and concepts discussed as well as the trade set-ups or examples that occurred that day.

Thank you for being a member and I hope you find value in these daily summaries.

Download the most recent report here:

July 31, 2012 (Click Here to Download)

SPECIAL REPORT:

Download: How to Make the Most of the Idealized Trades Report

New Members – always remember you have full access to prior months’ reports for review and additional examples of the concepts I teach and trade.

Archives:

July 2, 2012 Download July 2 2012

Further Trend Continuation, Popped Stops/Squeeze after Stick-Save (example), Retracements and Flags

July 3, 2012 Download July 3 2012

Pre-Holiday Session, Continuation of Popped Stops/Squeeze (manipulation/rumor of stimulus), More Retracements

July 4, 2012 – US Independence Day Holiday

July 5, 2012 Download July 5 2012

Post Holiday, Open Gap (Filled with a clear Stick-Save), Range Day development with Range Day lessons (refresh)

July 6, 2012 Download July 6 2012

Monthly Jobs Report, Expected Sell-off/Gap Down, Pro-Trend Day Retracements, Support and Reversal with TICK Kick-off

________________

July 9, 2012 Download July 9 2012

Bearish Range Day, Bearish Open, Range Plays in the Afternoon, Higher Timeframe support, Divergences and failed breakout (no kick-off)

July 10, 2012 Download July 10 2012

Big surprise bull trap, shift to alternate thesis, bearish breakdowns and retracements after morning ‘failure’

July 11, 2012 Download July 11 2012

Fed Minutes ‘surprise’ volatility, Morning Range Day and “Fade Trade” refresher lesson

July 12, 2012 Download July 12 2012

Surprise Rally, Stick-Save, Popped Stops Reversal, Bullish Retracements

July 13, 2012 Download July 13 2012

BIG T3 Power Trend Day due to Popped Stops/Resistance Breakout, Strong Retracements, Pro-Trend Trades ONLY (reminder)

_________________________

July 16, 2012 Download July 16 2012

Range Day, “Fade” Plays (lesson and reminder), “make-or-break” first opportunity (Trend vs. Range identification in real-time example)

July 17, 2012 Download July 17 2012

Bernanke Testimony (morning), Gap Fade/Fill (violent), Bearish retracement (FAIL), Popped Stops/Retracement trades, Lesson on “make or break” trade to determine structure

July 18, 2012 Download July 18 2012

ANOTHER T3 Trend Day ending in weakness, TICK Kick-off (but failed breakdown), bullish pro-trend retracement trades due to Popped Stops/Short-Squeeze

July 19, 2012 Download July 19 2012

Range Day, Reversal Play (great example) off $138 target, Range Day play refresher lesson

July 20, 2012 Download July 20 2012

Dominant Thesis T3 Trend Day Down (great example), Trend Day Tactics – Retracments/Flags

___________________

July 23, 2012 Download July 23 2012

Full Retest of Higher Timeframe 1,340 Target; Successful Reversal; Failed Trend Day Down; Breakout and “First Reaction” Plays

July 24, 2012 Download July 24 2012

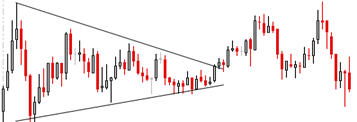

Failed “Make or Break” Support, Trendline Breakdown, T3 Trend Day into divergent/kick-off Reversal into close

July 25, 2012 Download July 25 2012

Wide Range Day, Opening Divergence/Fade, “Stick-Save” Example (clear), Bullish Bias AFTER the Stick-Save

July 26, 2012 Download July 26 2012

T3 Trend Day, ECB Stimulus Promise, Squeeze Play, Retracement Lesson

July 27, 2012 Download July 27 2012

Large Opening Gap, POWERFUL T3 Trend Day, Retracement/Breakouts, Dominant Thesis and Short-Squeeze

July 30, 2012 Download July 30 2012

Bull Trap/Divergence (Internals) Opening, breakdowns, Range Day plays off Bollingers/Trendlines (with divergences)

July 31, 2012 Download July 31 2012

Similar/Repeat Day, Opening Range, Bear Trap (divergences), Breakdown, Failed Bullish Reversal (Range Day into Close)