Idealized Trades for September 2011

Welcome, [firstname] !

Each day includes a description of some of the lessons and concepts discussed as well as the trade set-ups or examples that occurred that day.

Thank you for being a subscriber and I hope you find value in these daily summaries.

Download the most recent report here:

September 30, 2011 (Click Here to Download)

SPECIAL REPORT:

Download: How to Make the Most of the Idealized Trades Report

New Members – always remember you have full access to prior months’ reports for review and additional examples of the concepts I teach and trade.

Archives:

September 1, 2011 Download September 1 2011

Bullish Confluence Buy Fail – leading to Popped Stops breakout, simple retracement, dual divergences

September 2, 2011 Download September 2 2011

Big Jobs Report (Zero Created), Market Sell-off (as forecast by higher TF), “Finger” Stop-Loss Lesson, Breakdown/Retracements

________________

September 6, 2011 Download September 6 2011

V-Spike Surprise Reversal Day after Strong Gap Down (expected), Lesson on Popped Stops/Hidden Bullish Strength (Real-time monitoring)

September 7, 2011 Download September 7 2011

Powerful T3 Trend Day with Lessons (Popped Stops from Higher TF), Classic Retracement/Trend Day Lessons

September 8, 2011 Download September 8 2011

Choppy Range Breakdown, Trend Reversal on Classic Retrace Fail (lesson), Bernanke speaks

September 9, 2011 Download September 9 2011

T3 Trend Day Down, Europe, Simple Retracements and more T3 Trend Day Lessons (simplicity)

______________

September 12, 2011 Download September 12 2011

T2 Trend Day Down, Textbook Retracement Trades, V-Spike (News) Reversal, Classic Wyckoff/Kick-off Early Reversal Signal into Popped Stops

September 13, 2011 Download September 13 2011

V-Spike Trendline, Bullish Bias, Retracements and Popped Stops, Lesson on Trusting/Honoring Stops

September 14, 2011 Download September 14 2011

Repeat Day, V-Spike Trendline, Bullish Bias (breakout), Retracement & Popped Stops, Major Feedback Loop

September 15, 2011 Download September 15 2011

THIRD Repeat Day, V-Spike Trendline, Bullish Bias (breakout), Retracement & Popped Stops, Major Feedback Loop

September 16, 2011 Download September 16 2011

FOURTH (semi) Repeat Day, V-Spike, Morning Short, Popped Stops though weaker recovery (but good retracements at support)

________________________

September 19, 2011 Download September 19 2011

Gap and Semi-Rounded Reversal, Popped Stops good examples, 50 EMA (5-min) as Defining Line (Trend Day or not), Discussion Chart from 1979/1980

September 20, 2011 Download September 20 2011

Two Popped Stops/Feedback Loop Breakouts, Dual Divergences, Wyckoff/Kick-off, Higher Timeframe Levels (play between)

September 21, 2011 Download September 21 2011

Fed Day, “Operation Twist,” Feedback Loops and an initial Market Collapse

September 22, 2011 Download September 22 2011

T3 Trend Day (collapse) into $112 support, lesson on basic retracement trade logic

September 23, 2011 Download September 23 2011

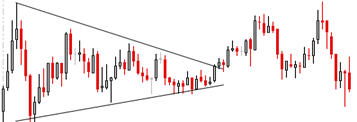

Range Day Consolidation, Dual Divergences, Trendline Triggers

_____________

September 26, 2011 Download September 26 2011

Bullish Breakouts, Retracements, Divergences, Popped Stops, “Value Area” discussion

September 27, 2011 Download September 27 2011

T3 Trend Day – devolved into V-Spike (divergent) Reversal with Wyckoff/Kick-off and Popped Stops (both ways)

September 28, 2011 Download September 28 2011

Sell Day, Importance of $117 (higher timeframe key lesson), dual divergences, bear flag, popped stops breakdown

September 29, 2011 Download September 29 2011

Sell Day, Importance of $117 and $114 (higher timeframe key lesson), REPEAT Day, Breakdowns and Big Dual Divergences

September 30, 2011 Download September 30 2011

Algorithmic “Manipulation” Plays off $114, Dual Divergences, “wide stops” lesson, Q3 end, Breakdown