Idealized Trades for September 2012

Welcome, [firstname] !

Each day includes a description of some of the lessons and concepts discussed as well as the trade set-ups or examples that occurred that day.

Thank you for being a member and I hope you find value in these daily summaries.

Download the most recent report here:

September 28, 2012 (Click Here to Download)

SPECIAL REPORT:

Download: How to Make the Most of the Idealized Trades Report

New Members – always remember you have full access to prior months’ reports for review and additional examples of the concepts I teach and trade.

Archives:

September 4, 2012 Download September 4 2012

Great Rounded Reversal example (divergences/kick-offs), Higher Timeframe Support Play (lesson)

September 5, 2012 Download September 5 2012

Tight Range Day, Triangle Breakout, Discussion on Game-Planning and Real-time Implementing (via Day Structure)

September 6, 2012 Download September 6 2012

T3 Power Trend Day and Great Example, Refresher Lesson, Flag/Retracement trades

September 7, 2012 Download September 7 2012

Consolidation Range Day, Range Day trade lesson, Jobs Report, Discussion on Stimulus

_______________________

September 10, 2012 Download September 10 2012

Morning Range Day (great example), afternoon Breakout Impulse after failed ‘fade’ trade (reference)

September 11, 2012 Download September 11 2012

Similar Repeat Day – Opening Range (fade trades like yesterday), Afternoon Breakdown (like yesterday)

September 12, 2012 Download September 12 2012

Similar Repeat Day – Opening Range (fade trades like yesterday), Afternoon Breakdown (like yesterday) (yes, it was almost identical)

September 13, 2012 Download September 13 2012

Fed Day and Press Conference; QE3 Begins, Huge (expected) Market Surge, Lesson on Power-Trend Days (how to frame and trade them)

September 14, 2012 Download September 14 2012

Post-Fed Day, Opening Impulse, Failed retracement signals reversal (lesson), and discussion of aggressive v. conservative tactics and stop-losses

________________________

September 17, 2012 Download September 17 2012

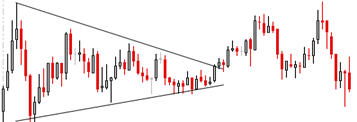

Tight Range Day, Clear Triangle, Lesson in “Breakdown and First Reaction” tactics to trade a range and breakout

September 18, 2012 Download September 18 2012

Another Tight Range Day, Classic Range Day Fade Trades lesson (with great examples)

September 19, 2012 Download September 19 2012

Weak Trend Day, Bullish Trendline Break into intraday resistance/failure. Good refresher lesson in classic flag/retracement trend day trades (despite weakness).

September 20, 2012 Download September 20 2012

Expected Bearish opening action, surprise bullish mid-day and afternoon action triggered by “bear flag” retracement failure (lesson).

September 21, 2012 Download September 21 2012

Bearish Continuation, low-volatility ‘creeper’ trend day, lesson in retracements and especially the “Breakout then First Reaction” recurring pattern

___________________________

September 24, 2012 Download September 24 2012

Gap, Trend Day Retracements/Flags, Flag Failure leads to Breakout Reversal and Popped Stops Play (great example)

September 25, 2012 Download September 25 2012

Initial flags, Support Break at both $146 and $145 with targets and retracement with breakdown trades accordingly

September 26, 2012 Download September 26 2012

Trend Day, Lesson in “make or break” moment (50 EMA), retracement trades, trend day logic.

September 27, 2012 Download September 27 2012

Opening Up-Gap, Stall into $144 Resistance, Stick-Save into Popped Stops/Squeeze Breakout (great example), T3 Trend Day (with first reaction example)

September 28, 2012 Download September 28 2012

Repeat Day, Opening Gap Down, Stall into $144; Stick-Save into Popped Stops, Breakout and First Reaction