Idealized Trades for April 2014

Welcome, [firstname] !

Each day includes a description of some of the lessons and concepts discussed as well as the trade set-ups or examples that occurred that day.

Thank you for being a member and I hope you find value in these daily summaries and lessons.

Download the most recent report here:

April 30, 2014

(Click Here to Download)

MEMBER NOTE:

Join me live each Tuesday Morning for the “Market Briefing” at TradeStation (anyone can register)

Member Glossary (Reference Page):

Idealized Trades Terminology Glossary Page (link)

By request, I’ve set-up a Member Glossary Page of Terms used in the Nightly Reports (such as “T3 Trend Day” or “Stick Save”).

Be sure to reference and bookmark this page and always feel free to email me with suggestions to expand it.

SPECIAL REPORT:

Download: How to Make the Most of the Idealized Trades Report

New Members – always remember you have full access to prior months’ reports for review and additional examples of the concepts I teach and trade.

Archives:

April 1, 2014 Download April 1 2014

POWERFUL T3 Trend Day “Collapse” – Dominant Thesis played out on trigger-break under 1,770 (best lesson). Simple strategies for power trend days.

April 2, 2014 Download April 2 2014

Market Manipulation/Stick-Save and Short-Squeeze for resistance breakout and bullish retracement trades in another Trend Day up

April 3, 2014 Download April 3 2014

Bull Trap/Failure (alternate thesis), breakdown and retracement bearish trades all day (stick save into the close)

April 4, 2014 Download April 4 2014

Bullish 1,900 full target (almost!) achieved, strong intraday reversal and collapse down (logical) from 1,900 level target. Retracements.

______________________________

April 7, 2014 Download April 7 2014

Failure to ‘bounce’ results in extended collapse of the market (T3 Trend Day Down with clear and simple retracements). End-of-day reversal bounce

April 8, 2014 Download April 8 2014

Expected Bounce/Rally up off support after a mini-Bear Trap and Stick-Save. Breakouts and Retracements (bullish only)

April 9, 2014 Download April 9 2014

Expected Bounce/Rally up off support after a mini-Bear Trap and Stick-Save. Breakouts and Retracements (bullish only) (this was essentially the same script as yesterday)

April 10, 2014 Download April 10 2014

Sharp Morning Reversal and Powerful T3 Trend Day Down to continue (and break) the Range (shy of full target)

April 11, 2014 Download April 11 2014

Powerful T3 Trend Day Down to continue dominant breakdown/breakout thesis.

_________________________

April 14, 2014 Download April 14 2014

Dominant bounce/rally thesis, retracements into clear rounded reversal (more retracements) and clear stick-save into the close

April 15, 2014 Download April 15 2014

Semi-repeat day, very similar in structure/opportunities to yesterday, use this as a great example of “Repeat Days”

April 16, 2014 Download April 16 2014

T3 Dominant/Expected Thesis Trend Day, retracements and breakouts (great example of planning and integration)

April 17, 2014 Download April 17 2014

REPEAT DAY T3 Dominant/Expected Thesis Trend Day, retracements and breakouts (great example of planning and integration)

________________

April 21, 2014 Download April 21 2014

Range into Stick-Save Manipulation Day, “Fades” into Creeper Retracements (stick save)

April 22, 2014 Download April 22 2014

Morning Breakout triggers instant Alternate Thesis and power T3 Trend Day (as expected). Trade Retracements ONLY.

April 23, 2014 Download April 23 2014

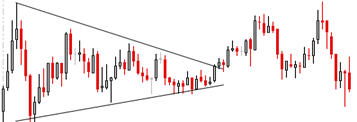

Range Triangle Day, Bearish Sell Retracements/Flags

April 24, 2014 Download April 24 2014

Clear Range Day, Dual Divergences, “Fade” Trades

April 25, 2014 Download April 25 2014

Bull Trap and Reversal (downside gap), T3 Trend Day, Great “Alternate Thesis” real-time adaptation (as expected on a break under $187)

______________________________________

April 28, 2014 Download April 28 2014

Surprise Morning Bull, reversal into resistance (not a surprise), downward impulse into Stick-Save Manipulation of the Market (clear example for those new to the concept)

April 29, 2014 Download April 29 2014

Continuation upside action following yesterday’s Stick-Save Manipulation – Creeping/low volatility Trend Day higher into resistance

April 30, 2014 Download April 30 2014

Downside open into Stick-Save Manipulation of the Market (three days in a row of examples!) into Breakout with Retracements on a typical FED DAY (textbook example)